Ethereum Price Prediction: Technical and Fundamental Analysis Points to $5,000 Target

#ETH

- Technical indicators show ETH trading above key moving averages with bullish pattern formation

- Whale accumulation and institutional interest provide fundamental support for price appreciation

- Accelerated network upgrades and development progress enhance Ethereum's long-term value proposition

ETH Price Prediction

ETH Technical Analysis: Bullish Breakout Potential

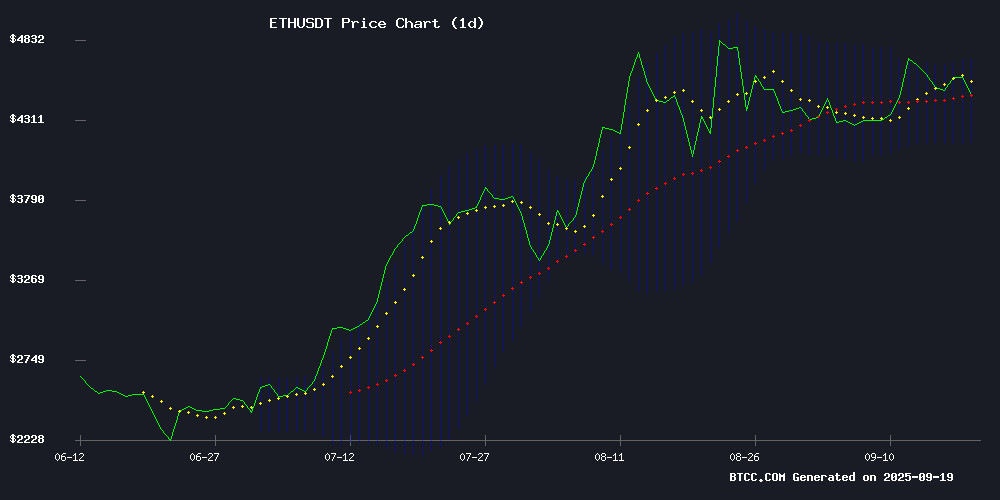

According to BTCC financial analyst Emma, Ethereum's current price of $4,459.21 is trading above its 20-day moving average of $4,436.89, indicating underlying strength. The MACD reading of -54.44 suggests some near-term bearish momentum, but the Bollinger Bands configuration shows price action NEAR the middle band with upper resistance at $4,707.38. Emma notes that a decisive break above the $4,630 level could trigger the next significant rally, with the technical setup supporting a move toward $5,000 in the coming weeks.

Market Sentiment: Bullish Fundamentals Support ETH Rally

BTCC financial analyst Emma highlights that recent developments are creating positive momentum for Ethereum. The bullish pennant formation identified by traders, combined with substantial whale accumulation, suggests institutional confidence in ETH's upward trajectory. Additionally, the accelerated Fusaka upgrade timeline to December 2025 demonstrates the development team's commitment to enhancing Ethereum's scalability and efficiency. Emma believes these fundamental factors, coupled with technical indicators, create a favorable environment for ETH to challenge the $5,000 resistance level.

Factors Influencing ETH's Price

Ethereum Bullish Pennant Formation Signals Potential Rally to $5,000 Amid Whale Accumulation

Ethereum's price consolidates near $4,500 within a bullish pennant pattern, a technical setup often preceding explosive breakouts. The $4,400-$4,500 range has emerged as strong support, while resistance persists at $4,700-$4,800. A decisive close above $4,800 could trigger an accelerated move toward $5,766, according to market analysts.

On-chain metrics reveal institutional conviction, with whales accumulating 820,000 ETH ($3.8 billion) in 72 hours. Exchange reserves have plunged to multi-year lows, creating a supply squeeze as demand escalates. This confluence of technical strength and fundamental demand paints a compelling bullish case for ETH's next leg upward.

Ethereum Developers Accelerate Fusaka Upgrade Timeline to December 2025

Ethereum's core developers have unexpectedly brought forward the Fusaka upgrade timeline, targeting mainnet activation for December 3, 2025—a significant acceleration from earlier projections extending into 2026. The decision follows intensive testing on Devnet-5, which revealed both software vulnerabilities and promising capacity improvements.

During brief periods of network stability, test results suggested implementing blob capacity increases in two phases: an initial boost to 10-15 blobs per block, followed by scaling to 14-21. These temporary data packets serve as critical infrastructure for Ethereum's layer-2 rollups, enabling cheaper transaction data posting to the blockchain.

The Prysm validator client emerged as a potential bottleneck during stress tests, struggling with high loads and producing orphaned blocks. Developers plan immediate follow-up testing on Devnet-6 to verify capacity thresholds before public testnet deployments begin in October.

Ethereum on the Edge: Will $4,630 Spark the Next Explosive Rally?

Ethereum hovers at $4,535 after a 1.72% dip, with trading volume plunging 34.93% to $30.82 billion. The pullback reflects retail profit-taking rather than structural weakness—ETH remains up 230% since Q2 2025 and lingers near all-time highs.

Critical resistance looms at $4,630, with a decisive breakout potentially igniting a rally toward the $4,874-$4,956 zone. Analysts note strong support at $4,460, backed by liquidity near $4,250. Market sentiment suggests consolidation is healthy after a parabolic run.

CryptoPulse highlights Ethereum's coiled-spring potential: A sustained push above $4,956 could trigger price discovery mode. The asset's resilience amid profit-taking underscores institutional confidence in its long-term value proposition.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, BTCC financial analyst Emma projects Ethereum could reach $5,000 in the near term. The combination of technical breakout patterns, whale accumulation, and positive network upgrades creates a compelling bullish case. Key resistance levels to watch include $4,630 for initial breakout confirmation and $4,707 as the next technical hurdle.

| Price Level | Significance | Probability |

|---|---|---|

| $4,630 | Initial breakout level | High |

| $4,707 | Bollinger Upper Band | Medium |

| $5,000 | Psychological resistance | Medium-High |